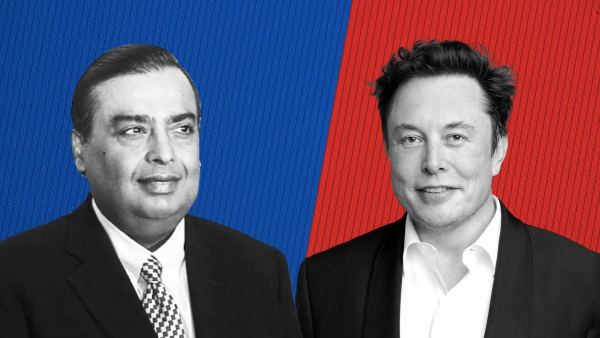

Elon Musk’s Starlink is set to enter India’s satellite internet market, going head-to-head with Mukesh Ambani’s Reliance Jio. This rivalry between two of the world’s richest men Musk and Ambani could change how internet services reach India’s remote areas.

The Backstory

Last year, Musk aimed to bring Starlink, his satellite-based internet service, to India, but the government denied them a license. Meanwhile, Mukesh Ambani partnered with Luxembourg-based SES to create

Jio Space Technology Ltd., aims to provide satellite broadband in India.

Ambani pushed for the government to auction the satellite spectrum, which would have favored Jio. However, Musk argued that the satellite spectrum should be shared equally among companies, not auctioned.

Countries like Brazil and the U.S. initially tried auctioning satellite spectrum but later switched to an allocation model due to its practicality. This week, India’s Telecom Regulatory Authority (TRAI) followed suit, announcing that the satellite broadband spectrum would be allocated, not auctioned. Hours later, Musk confirmed Starlink’s arrival in India.

Jio’s Monopoly at Risk

Currently, Reliance Jio controls 60% of India’s data traffic, making it the dominant player in the Indian internet market. But Starlink’s entry could break this monopoly. Unlike Jio’s fiber-optic cables, which are difficult to install in remote areas, Starlink uses satellites to deliver internet anywhere, especially to villages and terrains where traditional infrastructure is impractical.

Challenges for Starlink

Despite Starlink’s cutting-edge technology, its biggest challenge in India is pricing. Jio offers unlimited data for ₹471/month, while Starlink charges around ₹10,000/month, plus a ₹50,000 equipment fee. This could limit Starlink’s appeal to India’s price-sensitive consumers.

Security and Self-Reliance Concerns

Another concern is national security. Indian data staying within the country is crucial for security reasons, and Jio, being a domestic company, guarantees that. With Starlink, a foreign company, there are fears that Indian data could be routed through foreign servers, raising data sovereignty issues.

Moreover, allowing Starlink to operate in India could challenge the country’s AtmaNirbhar Bharat campaign, which emphasizes self-reliance in technology.

The Future of India’s Internet

India’s satellite broadband market is projected to reach $1.9 billion by 2030. While Jio has the advantage of low prices and local trust, Starlink’s advanced technology could revolutionize internet access in remote and underserved areas. The battle between Starlink and Jio will shape India’s future internet landscape. But will Indian consumers embrace Starlink’s high-tech solution despite the price difference?